The Centre for Planning and Economic Research (KEPE) outlined the complex economic scenario shaped by a series of positive but also worrying developments in the Greek economy.

It also highlighted the conditions that need to be in place for the current recovery to turn into sustainable future growth.

Positive developments

As pointed out by Professor Panagiotis G. Liargovas, president of the Board of Directors and Scientific Director of KEPE, among the positive developments stand out the relatively higher growth rates of the Greek economy compared to other Eurozone economies, the creation of high primary surpluses, the reduction of unemployment, inflation and public debt as a percentage of GDP, the increase of investments and exports, the improvement of the performance of the stock market, the strengthening of the banking system, the recovery of the investment grade and the improvement of the image of the country abroad.

According to KEPE, the main drivers of economic activity in the coming years will continue to be private consumption, investments, and exports, while the contribution of public consumption is expected to move marginally.

Inflation and the open fronts

Based on Eurostat’s harmonized index of consumer prices, inflation is expected to decline significantly in the coming years. In 2024 it is expected to stand at 2.8%, from 4.2% in 2023, reflecting lower energy commodity prices and the deceleration of food inflation.

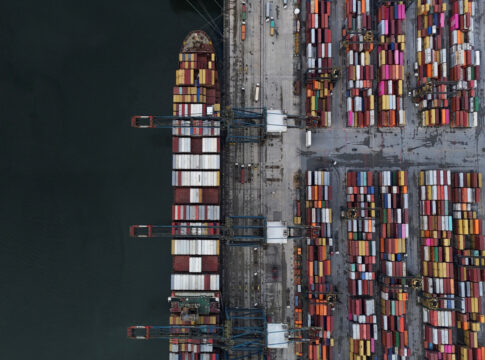

However, as KEPE warned, there are still many open issues: “According to ELSTAT’s recent data for the second quarter of 2024, consumption still leads exports and investments, contributing 88.7% of its total GDP of the country, a percentage similar to what was recorded in 2009. Private consumption stood at 70%, i.e., a ratio that has not changed for decades. Therefore, the annual GDP depends mainly on the disposable income of households, their financing, price levels and of course tourism which directly affects the index. It should also be noted that the increased consumer spending in the first half of the year is accompanied by the negative course of the trade volume index and unclear expectations in the retail sector. Despite the increase in consumption, the trade sector has not fully recovered, which creates uncertainty about the stability of consumption in the future. Meanwhile, investments, although increasing, are still low compared to the rest of the Eurozone countries.

New normality in the Greek economy

According to KEPE, as we move into the second half of the year, a new normality is beginning to emerge in the Greek economy. One of its first features is the fiscal framework, which will be implemented as of January. The new framework takes the form of “soft austerity.” The old primary surplus rules are being replaced, for the first time, by public spending rules. For Greece, the increase in public expenditure will be around 3.7 billion euros in 2025.

New banking landscape

A new banking landscape is underway. The good performance of the Greek economy and the upgrade of Greece’s credit rating to the investment category in 2023 had positive effects on the Greek banking system.

The main question

The main question is whether the current positive performance of the Greek economy will eventually prevail over the corresponding negative elements. That is, if the current recovery turns into sustainable future growth. This, according to the Center for Planning and Economic Research, will primarily depend on the international environment. Any worsening of the geopolitical crisis in Ukraine and the Middle East and the consequent effects on the international economic environment, may negatively affect the Greek economy.

But if this does not happen, then the course of things in the economy will depend on the government’s choices in the next three years, until 2027 when the funding from the Resilience and Recovery Fund will end. Until then, there is a plan and funding, so there is a window of opportunity. Therefore, it is up to the government to exploit this window of opportunity.