The next period is expected to be critical for Cenergy Holdings, which has set high goals regarding its activity in the international energy market, following the growing needs for energy infrastructure.

According to the announcement, the imminent increase of the company’s share capital to the amount of 200 million euros is in the final stretch.

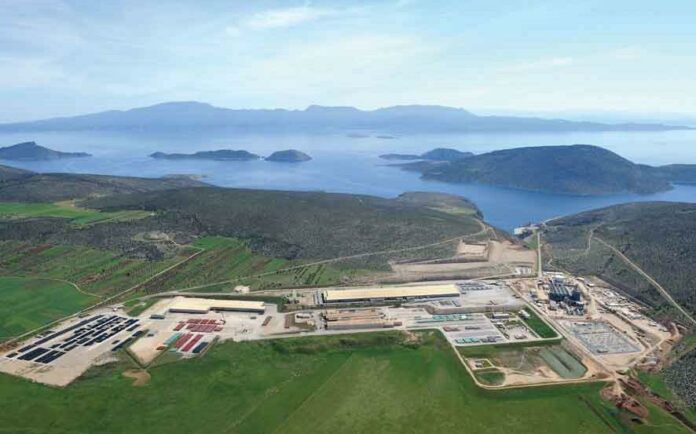

Net proceeds from the increase will be used primarily to finance the first phase of the Group’s planned construction of a cable manufacturing facility in Baltimore, Maryland, United States, as well as for general corporate purposes and, to the extent deemed necessary by the Group, to finance further improvements and expansion of the production capacity of the Group’s existing facilities in Greece.

The offer is expected to start in the coming days, while the delivery of the new shares is estimated to be completed around mid-October, subject to market conditions.

As Cenergy Holdings reported, more and more capacity is required to meet future energy needs. Also the installation of significant power generation capacity is expected to increase the need for power lines. It is estimated that global offshore wind capacity is projected to increase significantly by 2030.

The global power cable market will reach approximately 100 billion dollars by 2030 with a CAGR of 7% and a CAGR of 3% from 2030 to 2050.

The management of Cenergy Holdings emphasized that it sees a significant opportunity in the United States market, which is a large and rapidly growing market that exhibits similar long-term trends to other key markets, such as population growth, urbanization and the growing number of data centers, factors that are expected to increase the overall demand for energy.

The Group believes that it is in a position to take advantage of this promising opportunity in the US market, given its existing technological capabilities and proven track record of success.

The expansion program is fully aligned with the Group’s strategy of focusing on value creation over volume growth, increasing exports and optimizing operational excellence, efficiently serving the growing market in energy infrastructure.

As Cenergy Holdings emphasized in its update, the increase will be carried out by abolishing the legal pre-emptive rights of the company’s existing shareholders and applying a Preferential Distribution to Existing Minority Shareholders.

The maximum Offer Price at which the New Shares can be sold will be 9.86 euros/share. The new shares are expected to be offered through a public offering in Belgium and private placements to certain institutional investors in various jurisdictions, including (a) a private placement in the European Economic Area (b) a private placement in the United States of America, and (c) a private placement in certain specialist and/or institutional investors.

The new shares are expected to be listed for trading on the regulated market of Euronext Brussels and the Main Market of the Regulated Securities Market of the Athens Stock Exchange.