The European Banking Authority is promoting changes regarding the stress tests of Europe’s credit institutions to be carried out in 2025.

By publishing a draft for the stress tests, the European Banking Authority essentially starts the dialogue with the banks on how the new process will be carried out.

The authority explained that the main reason for the significant changes are the different risks faced by banks which they must incorporate into their models and metrics.

General risks

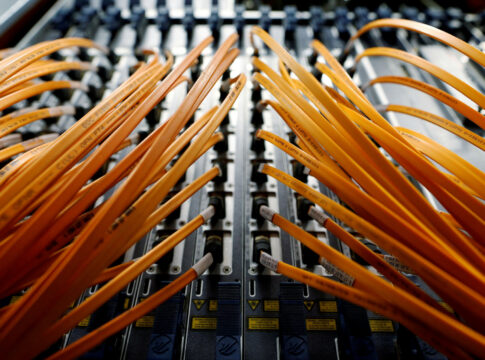

These are geopolitical and climate risks which differentiate market risks, while the operation of European banks has also undergone major changes by transferring classic banking operations to the internet.

Thus crypto and hacking issues, issues of digitization of credit institutions and their customers are important issues in the operation of banks.

Given that the credit system as a whole expects a drop in interest rates in a three-year period, what the supervisor wants to see is the way to replace the income and the corresponding provisions.

At the same time, changes are introduced regarding the revision of the trading portfolio, but also the risks faced by the loan portfolios from climate change.

Tests also incorporate classic credit risks, including securitizations.

Finally, operational risks are integrated, as well as classic market risks based on developments.