PPC Group’s strategic aim to meet the upgraded EBITDA target at the end of 2024 was underlined, among others, by the President and CEO of PPC George Stassis, speaking at the general shareholders meeting.

In particular, Stassis referred extensively to the “milestones” of 2023, underlining that the Group is on track for even better results compared to last year, having already adopted the target of 1.8 billion euro EBITDA.

Green portfolio

Presenting the Group’s key financial figures for 2023, PPC’s president and CEO reported that the Group’s investments reached 2.6 billion euros with increased investments in the renewable energy (RES) and distribution sectors, while the acquisition of Enel Romania was completed.

In addition, the Group’s “green” portfolio already counts 4.6 GW of RES projects in operation, while it has a RES portfolio of 2.8 GW under construction or ready for construction. It should be noted that approximately 70% of the remaining power required to achieve the 2026 goal has been secured.

Dividend distribution

The fourth milestone on the company’s path for 2023 is the proposal to distribute a dividend of 0.25 euros per share. PPC is proceeding with a dividend distribution after 10 years.

Stassis underlined that PPC’s change of course is now evident at all levels. He added that PPC is a healthy company with stable financial foundations, which was reflected in the financial results of 2023.

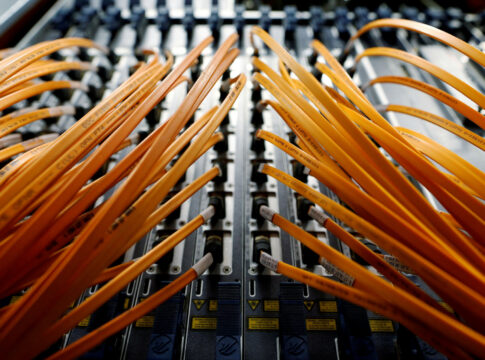

Presence in the field of telecommunications

At the same time, the company’s plans to promote its activities in the field of telecommunications through FiberGrid and with the fiber to the home service are in full development. Similar progress is also being made in the area of electric mobility, where PPC managed to double the charging points to a total of 2,000 in 2023 compared to the end of 2022.

Stassis pointed out that the transformation of PPC into a leading clean energy and critical infrastructure company is now a fact and is documented with specific numbers and data. The group shows strong results for 2023, progress on the RES plan, reduction of the carbon footprint and a significant acquisition in the expansion in Romania.

In addition, PPC records an increase in investments in RES and distribution, reinstatement of dividend while maintaining a disciplined financial position.

Finally, the company’s vertically integrated position allows for increased resilience to market fluctuations, while creating opportunities for further growth and value creation for the company’s shareholders, as he said.