The creation of a second network by PPC, competitive to that of OTE, if this eventually proceeds, under certain conditions, will enhance competition and lead to differentiating market shares.

Based on the annual revenues (2023) of the three providers, OTE (3.189.4 million), Vodafone (1.013 million) and Nova (829.7 million), OTE has a share of 63%.

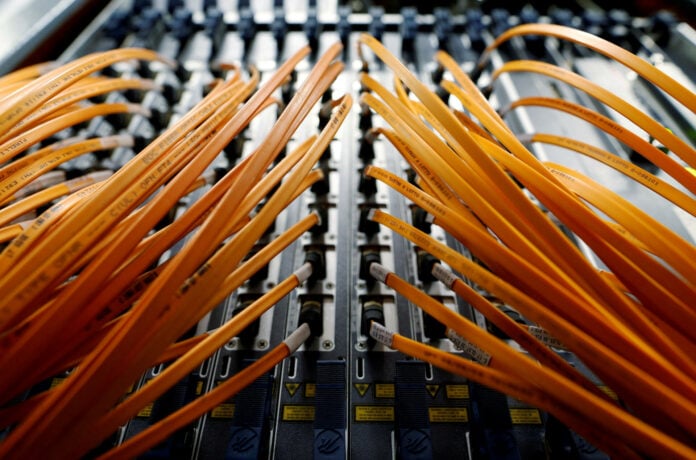

PPC has announced that it will install optical fiber to 3 million households and businesses (FTTH), at the same level with OTE, and so far it is building infrastructure in areas where the three existing providers operate.

However, PPC has not opened all its papers regarding its entry into telecommunications. Its management speaks of activity in the wholesale market. Its network will reach homes and businesses, and another operator will deliver the service to the end user.

In theory, Vodafone and Nova (even OTE) could also buy FTTH from PPC as long as it offers a lower wholesale price.

For this to happen, PPC will have to rush for the development of its telecommunications infrastructure, as the three existing providers, and especially OTE, are significantly ahead in terms of the construction of the new network.

In the next period, OTE, Vodafone, Nova, will sign the volume discount agreement which will result in all three preferring to buy from each other wholesale.

The above developments have made many market executives consider two likely scenarios for PPC in telecommunications.

The first is to provide telecommunication services directly to the end user and the second links it (directly or indirectly) to the imminent sale of Nova.