A total of 27% of the Greek population spent more than 40% of their disposable income to cover housing costs, giving Greece a negative lead compared to the rest of Europe.

Greece’s position in the ranking was affected by the low per capita income compared to the rest of the European Union countries, as the Bank of Greece (BoG) pointed out in the Financial Stability Report.

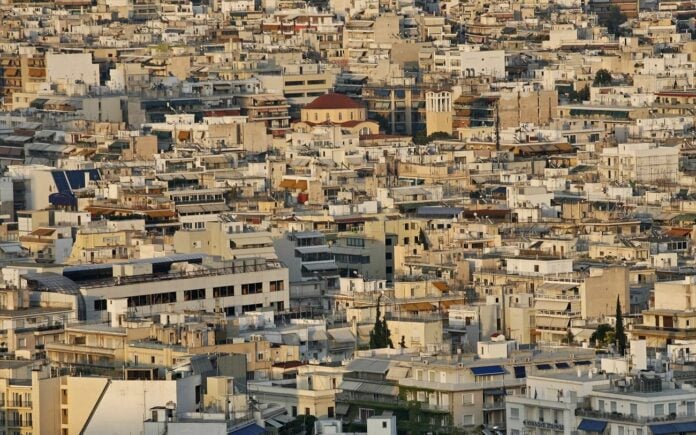

Greece also ranked first in terms of housing costs, despite the increase in the disposable income of households, as it was in the most unfavorable position among the countries of Europe.

According to the figures of the Finance Ministry:

– Apartment prices (in nominal terms) rose by 13.9% in the second quarter of 2023, year-on-year, compared to an increase of 11.8% in 2022.

– Prices of new apartments (up to 5 years old) increased at an average annual rate of 13.8%, in the second quarter of 2023, while prices of old apartments rose by 14.1%.

– In terms of geographic region, the prices in the country’s major urban centers rose significantly and more specifically in Thessaloniki (16.4%) and other major cities (14.6%), which exceeded the corresponding average growth rate for the entire country.

According to the Bank of Greece’s estimates, expectations for the Greek residential real estate market remain positive, despite the uncertainties in the domestic and global economy. In the short term, it is estimated that investment interest, mainly from abroad, will remain strong especially for specific privileged positions in the Attica basin and touristic areas.