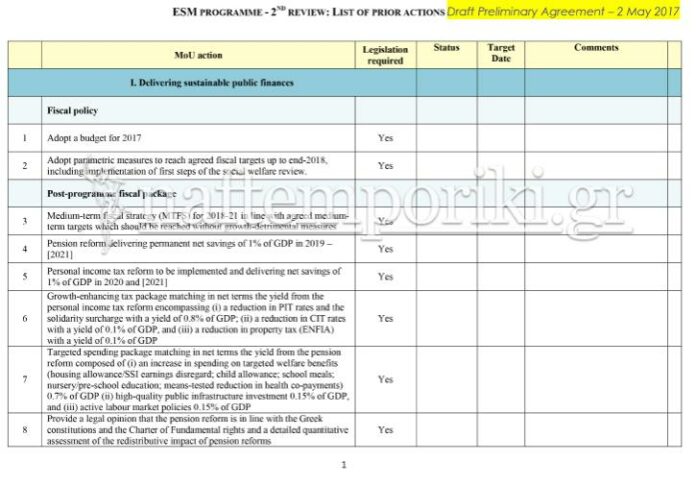

A complete list of all 140 prior actions that the Greek government must fulfill until the May 22 Eurogroup in order to achieve a staff-level agreement with creditors and free-up pending bailout loans was disclosed on Monday.

According to a document seen by “Naftemporiki”, the “draft preliminary agreement”, which is dated May 2, 2017, is called a “supplemental memorandum of understanding: Greece”.

The text is expected to be included in the final compliance report, and comes on the heels of statements by a Community source to “N” on Friday delineating the document’s highlights.

The document explains in detail the measures that must be implemented as of 2018, such as confirming a change in the manner in which social security contributions will be calculated, for instance – i.e. in a manner that will translate into higher contributions for most categories of self-employed professionals. The document also lists the austerity measures that the leftist government must take, as previously reported in great detail, as well as “countervailing measures” the Tsipras government has demanded for after 2019, ones conditional to fiscal targets.

The “positive measures” are described as the “targeted spending package”.

Several references are also made to the Greek side’s responsibility for ratifying the measures through Parliament and ensuring they are compatible with the Greek constitution – in a bid to preclude possible legal challenges.

Some of the more painful measures – called parametric – not prominently reported include a “latent” hike in social security contributions as of 2018; a reduction in a heating oil subsidy; abolition of unemployment benefits for newly hired workers and elimination of a tax discount.

The document also touches on labor relations, citing an “express” process for judging whether industrial actions are legal and even a re-examination of immunity from firing for elected unionists.

A 3.5 percent primary budget surplus, as a percentage of GDP, will remain in the “medium term”, according to the document, which in this case is cited as at least until 2021-2022, while the fiscal gap if calculated at 0.3 percent of GDP for 2018.

May 16 is given as a date for the Bank of Greece and the finance ministry to present a “road map” for further loosening capital controls in the Eurozone member.

In terms of the gasping efforts to try and manage an “Olympus-sized” mountain of bad debt in the country, the document states:

“Further measures are needed to tackle the large stock of Non-Performing Loans (NPLs) beyond the adopted legislation on loan market (servicing, sales) and step-up of supervisory monitoring and measures (NPE targets and KPIs). Debtors and creditors need an effective and efficient out-of-court and in-court debt restructuring and insolvency framework to reduce the debt overhang vis-à-vis both public and private creditors. Banks and the public sector need to speed up the restructuring of debts and the liquidation of non-viable businesses to support the recovery of the economy along with the gradual phasing out of capital controls.”